AvaTrade is a globally regulated multi-asset broker offering access to a diverse range of trading instruments across forex, CFDs, cryptocurrencies, commodities, indices, stocks, and options. The broker is particularly known for its multi-platform flexibility, offering both proprietary trading apps and full support for MT4/MT5 platforms.

For traders in the Philippines, AvaTrade presents a viable choice due to its international reputation, selection of platforms, and risk management tools. However, certain features and fees depend on regional availability, so due diligence is important.

Key Benefits of AvaTrade for Filipino Traders

Multiple Platforms Available

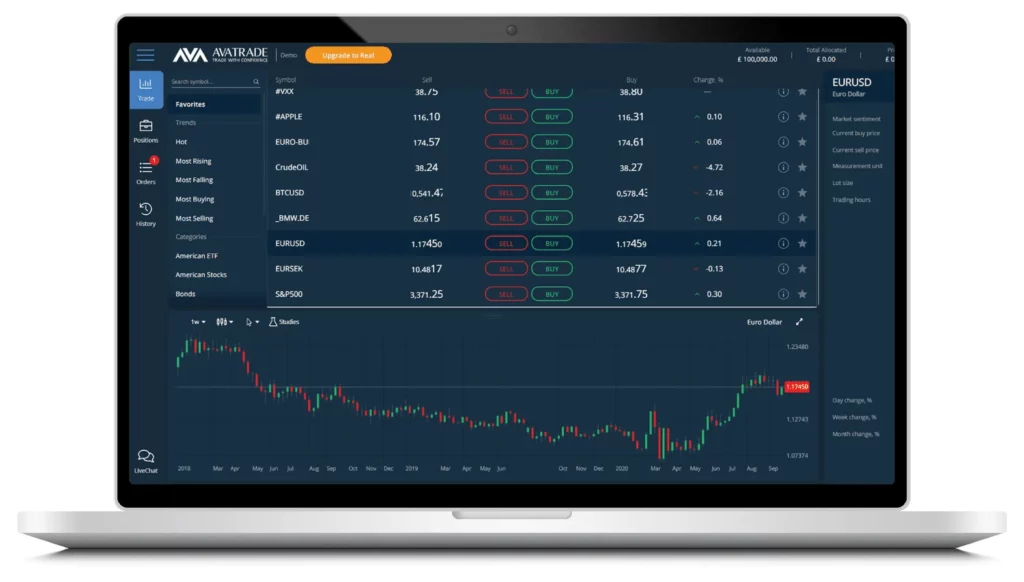

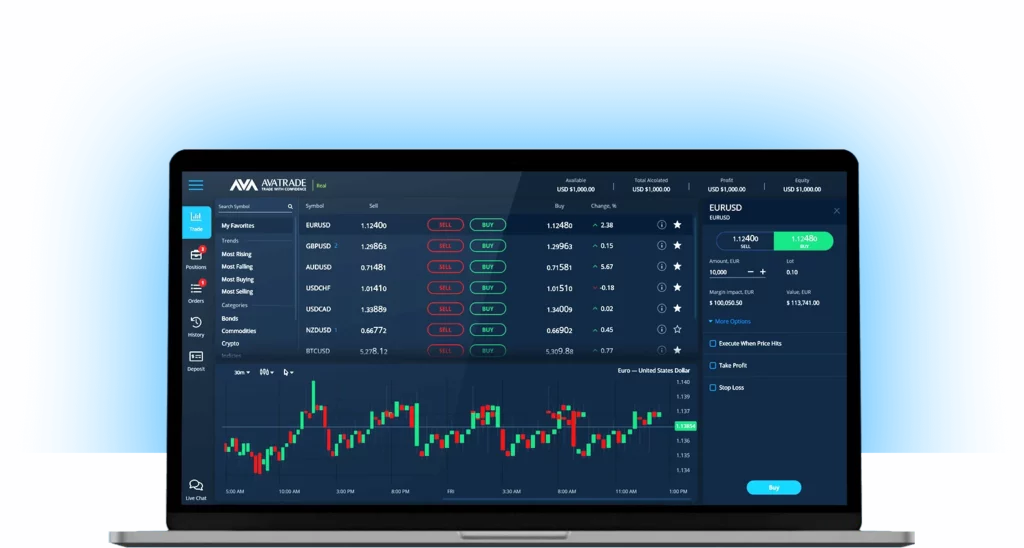

AvaTrade offers several platforms catering to different experience levels and preferences:

- AvaTrade WebTrader: Browser-based, no downloads, simplified interface for quick trading.

- AvaTradeGO App: A proprietary mobile app with intuitive design, market trend indicators, and one-click trading. Available on Android and iOS.

- MetaTrader 4/5 (MT4/MT5): Full support with EA trading, technical indicators, and advanced charting. Ideal for algorithmic and experienced traders.

- AvaOptions: Specialized platform for trading FX options, combining spot and vanilla options in one view.

Fixed Spread Options on Selected Instruments

AvaTrade offers fixed spreads on several major currency pairs and instruments, providing transparency and predictability for cost-sensitive strategies. This is a major advantage during volatile markets, as spreads do not widen unexpectedly.

- Examples of fixed-spread pairs: EUR/USD, USD/JPY (check trading conditions on the platform).

- Variable spreads are also offered, usually tighter during liquid market hours but can widen during news or low liquidity.

Tip: Filipino traders should confirm which instruments offer fixed spreads and compare them to variable alternatives for cost-effectiveness.

AvaOptions and FX Options Trading

AvaTrade is one of the few retail brokers that offer options on forex, via the AvaOptions platform. This feature is region-dependent and may not be available to all traders in the Philippines due to regulatory constraints.

- Vanilla options: trade calls and puts on currency pairs

- Integrated risk management tools: visual payoff diagrams, portfolio risk monitoring

- Expiry range: 1 day to 1 year

Important: Filipino traders should contact support or try the demo to verify access to AvaOptions.

Risk Management Tools

AvaTrade includes advanced tools for managing risk, particularly helpful for beginners and swing traders:

- Guaranteed stop loss orders (GSLO): Available on selected instruments (extra premium may apply)

- Negative balance protection: Ensures traders cannot lose more than their deposit

- Trailing stops, Take profit/Stop loss levels

These tools add confidence and structure to your trades, especially when trading in volatile environments.

Platform Accessibility in the Philippines

AvaTrade accepts clients from the Philippines, and their platforms are accessible via:

- Local IPs – no VPN needed

- Bank cards and e-wallets – funding options may vary slightly

- 24/5 support – English live chat, email, and phone (international)

However, not all services (like AvaOptions or crypto trading) may be available due to local financial regulations. Always check account settings and terms upon registration.

Fees Filipino Traders Should Watch Out For

While AvaTrade advertises zero commission trading, there are some non-trading fees that Filipino users should be aware of:

Inactivity Fees

- Charged $50 every 3 months after 3 months of inactivity.

- A $100 administration fee is charged after 12 months of non-use.

Advice: Log into your account at least once every few months—even if not actively trading.

Conversion Fees

- Accounts are set in USD, EUR, GBP, AUD, depending on region.

- If you deposit in PHP, a currency conversion fee will apply.

- Avoid unnecessary conversions by using a USD or EUR account from your local bank or e-wallet (like Skrill or Neteller).

Withdrawal Fees

- AvaTrade itself does not charge withdrawal fees.

- However, third-party charges (e.g., bank or e-wallet fees) may apply, especially for international wires.

Tip: Choose e-wallets like Skrill or Neteller to reduce withdrawal costs and speed up the process.

Final Thoughts: Is AvaTrade Right for Filipino Traders?

Pros

- Supports both MT4/MT5 and AvaTrade proprietary platforms

- Fixed spread options available for better cost control

- Risk tools like guaranteed stops and negative balance protection

- Competitive access to FX options (if available in your region)

Cons

- AvaOptions and some advanced tools may not be available in the Philippines

- Inactivity and conversion fees can add up

- No PHP account currency support

Recommendation for Traders in the Philippines

AvaTrade is a strong choice for intermediate to experienced traders in the Philippines who seek platform flexibility and advanced risk tools. Beginners can benefit from AvaTradeGO, while seasoned traders can leverage MT5 or AvaOptions (if available). However, traders should:

- Check regional restrictions on options and cryptocurrencies

- Be proactive in avoiding inactivity and conversion charges

- Verify spread types and platform functionality during peak hours

Best use case: Forex and CFD trading with risk-managed strategies and predictable costs.