eToro is a global multi-asset broker known for its copy trading features, making it particularly attractive to Filipino traders who are starting out or exploring diversification.

What Makes eToro Useful for Filipino Traders

Multi-Asset Access with Simplicity

eToro supports trading across:

- Stocks (US, EU, Asia)

- ETFs

- Indices

- Crypto CFDs (availability depends on location)

- Forex pairs

- Commodities (gold, oil, etc.)

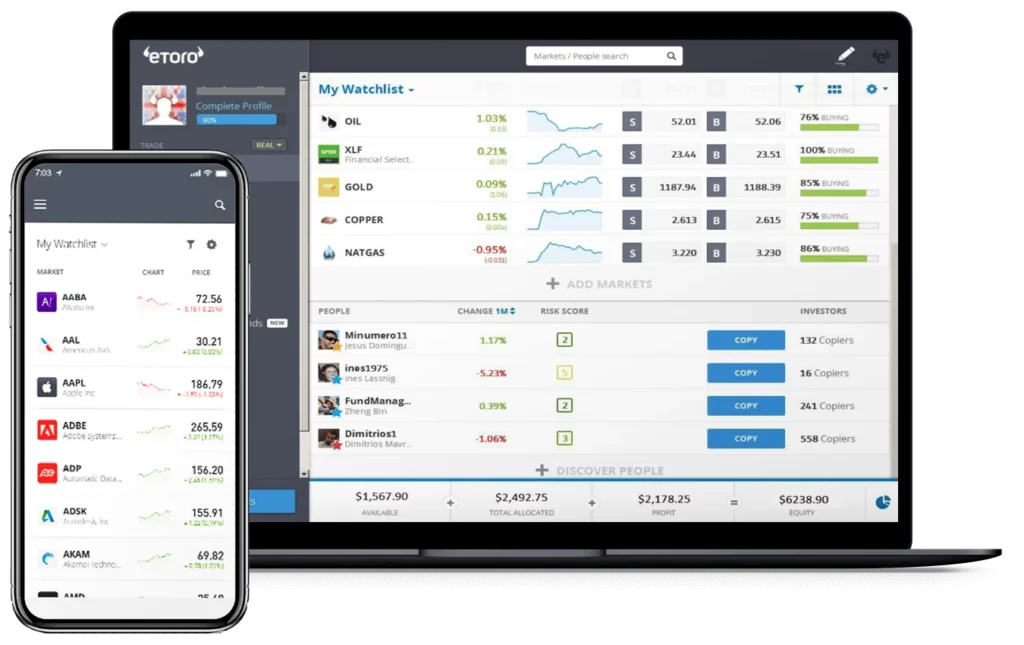

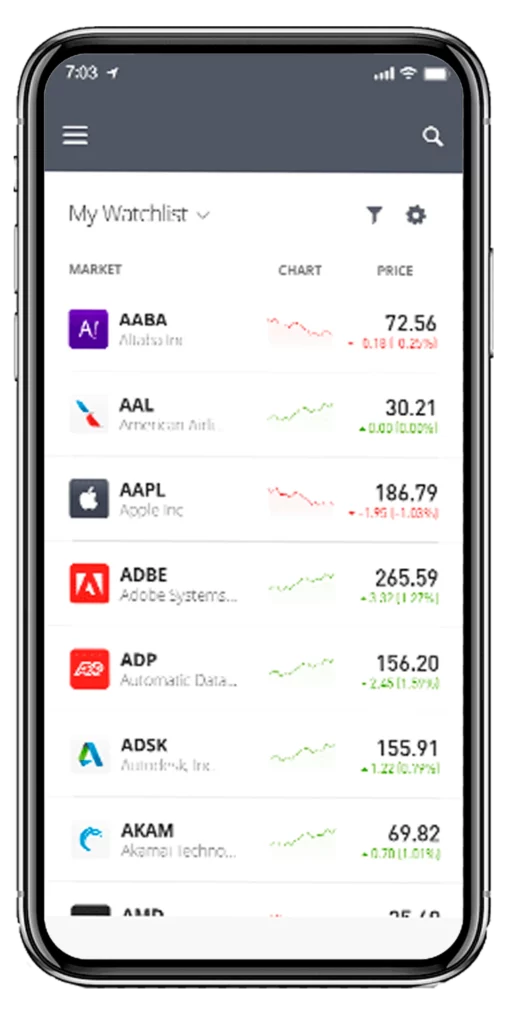

The interface is clean and mobile-friendly. Account creation is quick, with ID verification and deposit options via cards or e-wallets, which suits many Philippine-based users.

Social & Copy Trading Layer

eToro allows you to:

- Follow and copy top-performing traders.

- View track records, risk scores, drawdowns, and copier stats.

- Set allocation limits, stop-losses, and diversify strategies.

This helps new traders get market exposure while learning in real time.

Fractional Shares and No Minimum Lot

With fractional investing, Filipinos can buy US stocks (like Apple or Tesla) with as little as $10, skipping the high entry barrier found on other platforms.

Key Points to Double Check Before Using eToro

Cost Model on CFDs

eToro uses a spread-only model, meaning no upfront commission, but trading costs are embedded. This may result in higher costs depending on the asset.

Overnight Fees on Leverage

Leverage beyond 1:1 triggers daily swap fees, especially on CFDs for crypto, forex, and commodities. Always check the “Fees” section before holding a position overnight.

Currency Conversion & Withdrawal Fees

- All accounts run in USD. If you deposit PHP, it’s auto-converted.

- Deposits and withdrawals via GCash, Maya, or Visa cards may incur currency conversion and processing fees.

- Withdrawal fee: $5 per transaction.

Regulation and Safety

eToro is regulated by several international bodies:

- CySEC (EU clients)

- FCA (UK)

- ASIC (Australia)

However, Filipino clients fall under the offshore entity, typically registered with the Seychelles or BVI arm. This means:

- Investor protections are limited

- No local Bangko Sentral ng Pilipinas (BSP) oversight

- No deposit insurance

You’re trusting a global brand, but not under Philippine regulation. Always weigh this before depositing significant funds.

App Usability and Tools

The eToro mobile app works well on both Android and iOS, and includes:

- Real-time charts with basic technical indicators

- CopyTrader settings and watchlists

- Alerts and price notifications

That said, charting tools are basic. If you rely heavily on advanced technical analysis, consider pairing eToro with TradingView (which it integrates with via chart export).

Educational Content for Beginners

eToro offers a helpful “Academy” section with:

- Glossaries

- Short video tutorials

- Market news and thematic reports

Filipino traders who are just starting out can use this as a foundation. However, the content is mostly English-based and might feel surface-level to more advanced users.