IG is a globally recognized multi-asset broker known for its vast selection of markets, professional trading tools, and strong regulatory reputation. Founded in 1974, IG has become one of the most trusted names in online trading, offering access to forex (FX), commodities, indices, shares, and cryptocurrencies through a single, user-friendly platform. For traders in the Philippines, IG provides a secure, transparent, and feature-rich trading environment designed to meet both retail and professional needs.

Strengths of IG

Extensive Market Access

IG offers one of the largest market selections in the industry. Filipino traders can trade over 17,000 markets, including global stock indices, major and exotic FX pairs, precious metals, energy commodities, and company shares from leading exchanges. This diversity allows traders to balance risk and find opportunities across various asset classes.

Professional Charting and Analysis

IG’s web terminal and trading platforms feature institutional-level charting tools. Traders can apply dozens of technical indicators, use drawing tools, and customize chart templates. Combined with real-time market news, sentiment analysis, and economic data, this setup helps traders make informed, data-driven decisions.

Educational Resources and Research

IG is known for its robust educational ecosystem. Traders can access:

- Step-by-step courses for beginners and advanced guides for professionals.

- Regular webinars and market commentary from IG analysts.

- An active community and trading academy that helps Filipino traders continuously improve their skills.

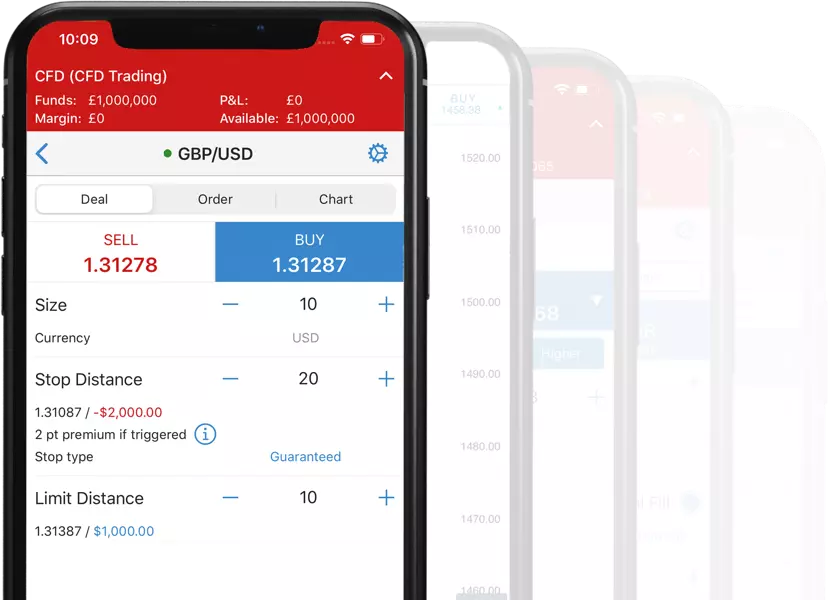

Pre-set Orders and Alerts

IG’s order system supports precise trade management with stop-loss, limit, and trailing stop orders. Traders can also create custom alerts for price movements, economic announcements, or margin levels. These features make the trading process smoother and help maintain control in fast-moving markets.

Trading Platforms and Mobile Access

IG provides flexible and high-performance platforms suitable for all trading styles.

- IG Web Platform: A clean, intuitive interface for browser trading. It includes advanced charting, news feeds, and position management tools.

- MetaTrader 4 (MT4): For those who prefer algorithmic trading and Expert Advisors, MT4 is fully supported with fast execution and stable connectivity.

- Mobile Trading App: Filipino traders can trade on the go using IG’s mobile app, available for both iOS and Android devices. The app mirrors the full desktop experience — from chart analysis to live order management.

All platforms are synchronized, allowing traders to switch between desktop, web, and mobile seamlessly without losing progress or open positions.

Regulation and Security

IG operates under top-tier regulatory supervision, ensuring safety and transparency for clients. The broker is regulated by authorities such as the Financial Conduct Authority (FCA, UK), Australian Securities and Investments Commission (ASIC), and other respected institutions.

For traders in the Philippines, this provides a strong sense of trust and protection. IG maintains segregated client funds, uses SSL encryption for transactions, and follows strict anti-money laundering (AML) procedures. The company’s long history and clean compliance record make it one of the most reliable brokers in the global market.

Points to Check Before Trading

1. Share-CFD Financing and Borrow Fees

When trading share CFDs, traders should review overnight financing charges and borrow rates for short positions. These costs differ depending on the instrument and region. Filipino traders should verify exact rates on the IG platform before trading.

2. Minimum Trade Sizes

Each asset class has a specific minimum trade size. For instance, FX trades typically start from 0.01 lots, while indices and commodities have contract-based minimums. Understanding these limits helps traders manage capital more efficiently.

3. Local Deposits and Conversion Rates

IG supports various payment options, including bank transfers and card payments. Traders in the Philippines should check available local methods and conversion fees when depositing or withdrawing in Philippine pesos (PHP). This helps avoid unexpected charges and optimize fund management.