Interactive Brokers (IBKR) is a global trading platform recognized for its extensive market access, advanced technology, and competitive pricing. It caters to both professional and retail traders who demand precision, flexibility, and transparency in global trading.

Global Venue with Broad Market Access

Interactive Brokers connects traders to over 150 markets in 30+ countries, including equities, options, futures, forex, bonds, ETFs, and funds. For traders in the Philippines, this means seamless access to U.S., European, and Asian exchanges — all from a single account.

The platform’s infrastructure supports multi-currency trading, allowing users to manage assets across markets without opening accounts in multiple regions. This is particularly advantageous for Filipino traders who want to diversify their portfolio globally or hedge against local currency fluctuations.

Why It Appeals to Systematic Traders

IBKR stands out as a preferred choice for systematic traders and algorithmic investors. Through its powerful API (Application Programming Interface), users can automate trading strategies, connect third-party software, or develop custom models in languages such as Python, Java, or C++.

This makes IBKR ideal for data-driven traders who rely on analytics, backtesting, and execution speed. The platform also integrates with tools like MetaTrader, NinjaTrader, and TradingView, making it adaptable to different trading styles.

Low Margin Rates and Competitive Fees

One of the strongest advantages of Interactive Brokers is its low margin rates, especially in select regions. The broker consistently offers some of the lowest interest rates on margin loans among major global brokers, which can significantly reduce trading costs for active traders.

In addition, IBKR’s commission structure is transparent and competitive, appealing to both frequent traders and investors managing larger portfolios. Filipino traders benefit from this cost efficiency when trading on major global exchanges.

Smart Order Routing for Equities and Options

IBKR’s SmartRouting system is another standout feature. It automatically routes orders to the best available market for price improvement and execution speed, scanning multiple venues in milliseconds. This system enhances execution quality for stocks and options, ensuring traders receive the most favorable trade prices.

For high-volume or institutional traders in the Philippines, this functionality can translate into measurable savings and improved overall performance.

Regulation and Security

Interactive Brokers operates under some of the strictest financial regulations in the world. It is supervised by authorities such as the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Financial Conduct Authority (FCA) in the UK, and others across multiple jurisdictions.

For traders in the Philippines, this strong regulatory framework ensures that funds are kept in segregated accounts and that client activities are handled with full transparency. The platform uses two-factor authentication (2FA), data encryption, and real-time monitoring systems to protect client assets and personal information.

This combination of oversight and technology provides Filipino traders with peace of mind when trading internationally.

Educational and Research Tools

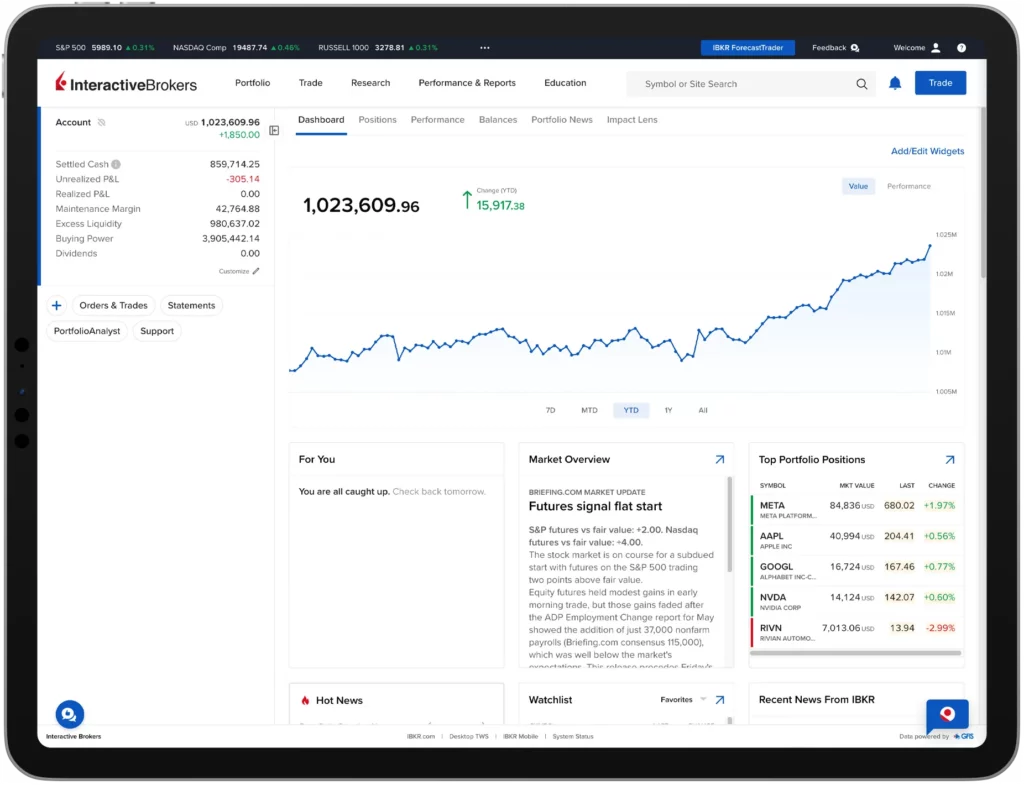

Interactive Brokers places great emphasis on trader education and research. The IBKR Campus offers webinars, video tutorials, market updates, and trading courses suitable for both beginners and professionals.

Additionally, traders gain access to advanced research tools such as IBKR Global Analyst, PortfolioAnalyst, and Trader Workstation Reports, which help in analyzing performance, evaluating risks, and making data-backed decisions.

For Filipino traders looking to improve their trading skills and understand global market trends, these resources can be invaluable in building long-term success.

Points to Consider Before Opening an Account

While Interactive Brokers offers exceptional functionality, traders should be aware of several key aspects:

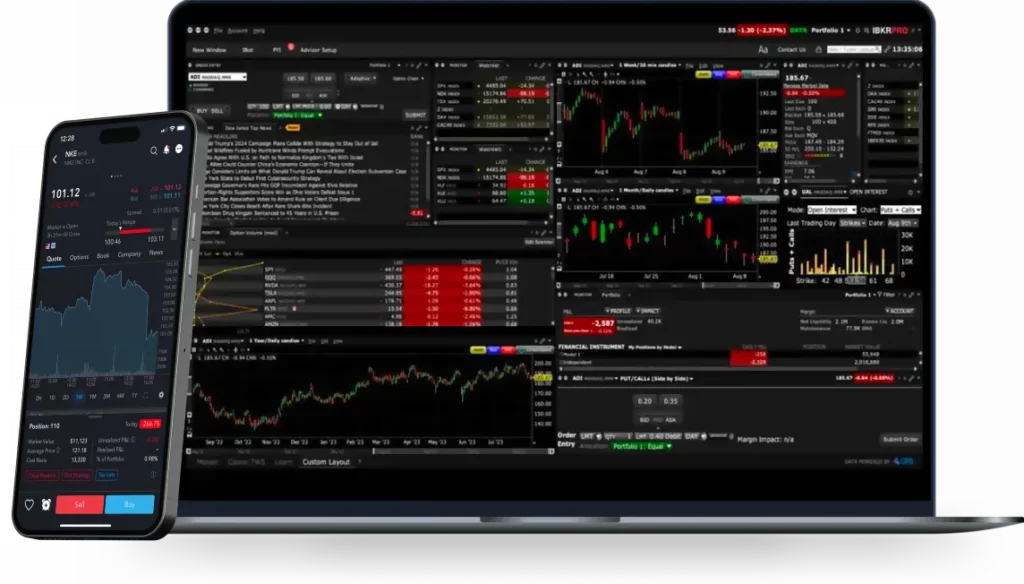

- Platform Learning Curve: IBKR’s Trader Workstation (TWS) is powerful but complex. New users may need time to master its interface and tools. However, once understood, it offers unmatched depth and customization.

- Market Data Subscriptions: Real-time quotes require paid market data subscriptions. Without them, traders will only see delayed prices. Active traders often choose tailored data packages to optimize their strategies.

- Funding in Local Currency: Philippine traders can fund their accounts via international bank transfers. However, deposits and withdrawals are handled in major currencies like USD, EUR, or SGD. Currency conversion fees may apply, so it’s essential to understand IBKR’s conversion rules and possibly maintain multi-currency balances to avoid unnecessary costs.