Plus500 is a trusted name in CFD trading, offering access to a wide range of global markets through a clean and efficient interface. Filipino traders can trade indices, forex pairs, commodities, and selected equities using a system that prioritizes simplicity, transparency, and smooth execution.

The platform is designed to make order placement quick and reliable, with tools that help traders manage risk effectively. Plus500 operates under strong regulatory oversight, giving users additional confidence when managing positions in volatile markets.

Key Highlights

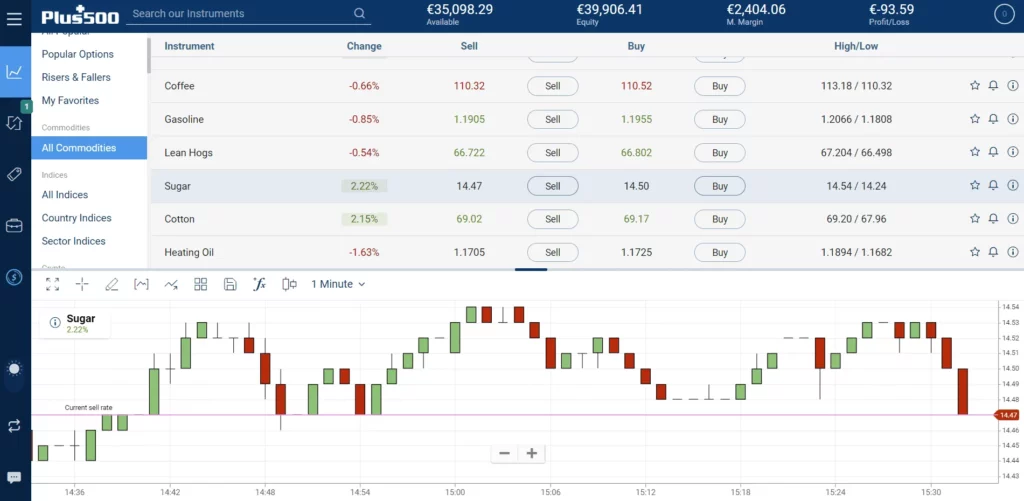

- Clean Charts and Accurate Orders: Plus500’s interface provides minimal distractions, allowing users to focus on price action. Orders are executed quickly, and chart performance remains stable, even during periods of high volatility.

- Guaranteed Stop-Loss Option (GSLO): Traders can use GSLO to lock in maximum potential loss, ensuring protection against major market gaps. This feature carries a small premium but is valuable for managing risk in fast-moving markets like FX or indices.

- Simple Account Tiers and Funding Flow: Account management on Plus500 is straightforward. Deposits and withdrawals are processed through major cards, e-wallets, and local banking options. Filipino users benefit from clear transaction tracking and no hidden tier conditions.

Important Points to Check

- Spread-Only Pricing Model: Plus500 operates without commissions, using a spread-only structure. However, spreads may widen during off-market hours or when liquidity drops.

- Instrument Availability by Country: The list of tradable instruments varies across regions. Traders in the Philippines should confirm which symbols are available before funding an account.

- GSLO Costs and Rules: Guaranteed Stops have fixed distance requirements and additional charges. Understanding these rules helps manage leverage and capital more efficiently.

Account Types and Verification

Plus500 maintains a single account type, simplifying access for traders. Every user receives the same set of tools, leverage settings, and market data. This eliminates confusion about tiered benefits or hidden limits.

Verification is mandatory to comply with KYC (Know Your Customer) standards. Filipino traders must provide identification and proof of address before withdrawals are processed. This step enhances account security and ensures regulatory compliance.

Asset Coverage and Market Access

Plus500 offers CFDs across various asset classes:

- Forex: Major and minor pairs with tight spreads.

- Indices: Global indices such as NASDAQ 100 and FTSE 100.

- Commodities: Gold, crude oil, and silver.

- Equities: Popular global shares from the U.S., U.K., and Asia-Pacific.

This range supports both short-term trading and longer trend-following strategies, allowing users to diversify within one platform.

Risk Management and Trading Tools

Beyond GSLO, Plus500 includes several practical tools:

- Price Alerts notify traders when key levels are hit.

- Trailing Stops automatically lock in profits as prices move.

- Negative Balance Protection prevents losses beyond deposited funds.

These features encourage disciplined trading and reduce exposure during volatile market periods.

Education and Support

Plus500 provides concise guides covering topics like margin, leverage, and CFD mechanics. While the educational content is basic, it helps beginners understand key concepts.

Customer support is available 24/7 via live chat and email, with quick response times and localized assistance for Filipino users.