What is the Exness Investment Calculator?

The Exness Investment Calculator is a powerful online tool designed to help traders and investors accurately assess the potential risks and rewards associated with their trading strategies. Developed by Exness, a leading global forex broker, this calculator provides a comprehensive analysis of various factors that affect trading results, including leverage, position size, spreads, commissions, and swap rates .

Main Features of Exness Calculator

The Exness Investment Calculator offers a set of powerful features designed to assist traders in analyzing and optimizing their trading strategies.

Assessing Potential Profits and Risks

One of the main features of the Exness Investment Calculator is the ability to accurately assess the potential profit and risk associated with a given trading position. By entering relevant parameters such as entry price, stop-loss, and take-profit levels, traders can quickly identify potential gains or losses associated with a trade. This valuable information empowers traders to make informed decisions and effectively manage their risk exposure.

Additionally, the calculator takes into account various factors that can affect trading results, such as leverage, position size, and market conditions. By considering these elements, the tool provides a comprehensive analysis, enabling traders to understand the potential implications of their trading decisions.

Customizable Investment Scenarios

The Exness Calculator offers a high degree of customization, allowing users to tailor the tool to their specific trading preferences and account settings. Traders can choose from a wide range of trading instruments, including major and minor currency pairs, cryptocurrencies, stocks, and commodities. Additionally, they can select their preferred account type, leverage, and account currency, ensuring that the calculations accurately reflect their trading environment.

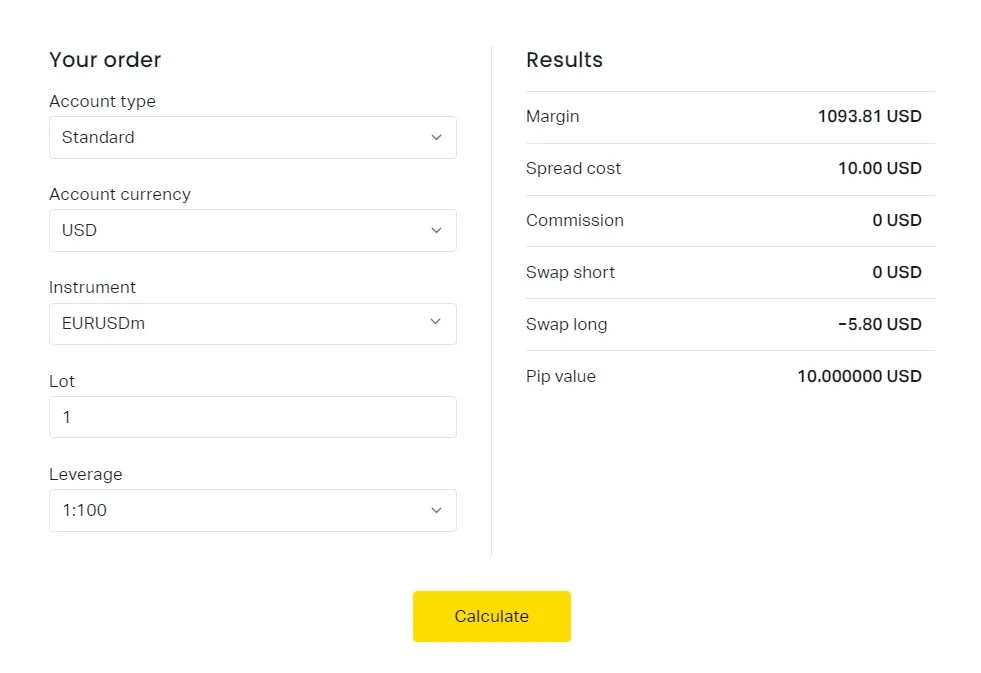

Using the Exness Investment Calculator

To fully utilize the capabilities of the Exness Margin Calculator, traders must follow a few simple steps to ensure accurate and relevant calculations.

Selection of Account Type and Trading Instrument

To start using the Exness Investment Calculator, traders must first select the appropriate account type and trading instrument. This initial step is very important because it sets the foundation for accurate calculations and adapts the tool to the specific needs of the trader.

When choosing an account type, traders can choose from:

- Standard account (Standard, Standard Cent)

- Professional account (Raw Spread, Zero, Pro)

Each account type offers unique features and requirements, catering to different preferences and trading strategies.

Next, traders must select the specific trading instrument they wish to review. The Exness Investment Calculator supports a wide range of instruments, including:

- Forex currency pairs (major, minor, and exotic)

- Stocks

- Goods

- Cryptocurrencies

By choosing the appropriate trading instrument, traders can ensure that calculations are tailored to the specific market conditions and characteristics of their chosen asset.

Input Position Size, Entry Price, and Leverage

After selecting the account type and trading instrument, traders must enter the necessary parameters for their desired trade. This includes specifying the size of the position (in lots or units), the entry price at which the trade is intended to be opened, and the leverage ratio they wish to use. Accurate input of these variables is essential for obtaining reliable calculations and risk assessments.

Account Currency Selection

The Exness Margin Calculator also allows traders to select their preferred account currency. This feature is particularly useful for traders who operate in different regions or those who prefer to analyze their trades in a specific currency. By selecting the appropriate account currency, the calculator can provide accurate calculations that are consistent with the financial outlook of the trader.

Interpreting the Results

Once the required inputs are provided, the Exness Investment Calculator generates comprehensive results to assist traders in evaluating their trading strategies.

Margin Requirements and Effect of Leverage

The calculator shows the margin requirements for the specified trade, taking into account the leverage ratio and position size. This information is important for traders to ensure they have enough funds in their account to maintain their positions and avoid potential margin calls.

Spread Cost and Commissions

The Exness Investment Calculator provides a detailed breakdown of the spread cost and any applicable commissions associated with the trade. This information is important for traders to assess the total cost of executing their strategies and to incorporate it into their risk management and profitability calculations. The calculator usually shows:

- Amount of Spread:

- The difference between the bid and ask prices for the trading instrument

- Represents the value of entering and exiting a position

- Commissions:

- Additional fees charged by the broker for executing trades

- May vary based on account type, trading volume, or other factors

By having a clear understanding of these costs, traders can make informed decisions about their trading strategies, account for potential costs, and accurately calculate their potential profits or losses.

Costs of Changing and Holding Positions

For trades held overnight or over extended periods, the Exness Investment Calculator provides an estimate of swap amounts or position holding fees. This insight allows traders to make informed decisions about the potential costs of holding their positions and plan their exit strategies accordingly.

Pip Value for Selected Instrument

The Exness Investment Calculator displays the pip value for the selected trading instrument. This value represents the amount of money associated with a pip movement in the price of the instrument, allowing traders to accurately calculate their potential profits or losses based on expected price fluctuations. The pip value is usually shown as:

- Pip Value:

- The monetary value of a pip movement

- Varies based on trading instrument, position size, and account currency

- Potential Profit/Loss:

- The calculator shows the potential profit or loss for a given pip movement

- Helps traders understand the impact of price changes on their trade

By understanding the pip value, traders can better analyze the risk-reward ratio of their trades and make informed decisions about position size and risk management strategies.

Exness Calculator vs. Traditional Methods

While traditional methods of calculating potential profits, risks, and costs associated with trading have served traders for years, the Exness Investment Calculator brings a level of convenience, accuracy, and sophistication that excluding it. Unlike manual calculations or spreadsheets, which can be time-consuming and prone to errors, the Exness Calculator offers an all-in-one solution that streamlines the process.

One of the main advantages of Exness Calculator is its user-friendly interface. With just a few clicks, traders can enter their desired parameters and immediately receive a comprehensive analysis. This ease of use not only saves time but also reduces the possibility of mistakes that can occur in manual calculations.

Additionally, the Exness Calculator takes into account a wide range of factors that can affect trading results, such as leverage, position size, spreads, commissions, and swap rates. By considering all these elements, the calculator provides a more accurate and holistic view of the potential risks and rewards associated with a trade. This level of detail is often overlooked or simplified in traditional methods, leading to potential miscalculations or oversights.

Another significant benefit of the Exness Calculator is its ability to handle a variety of trading instruments, from forex currency pairs to stocks, commodities, and cryptocurrencies. This versatility allows traders to analyze their entire portfolio within one platform, eliminating the need for multiple tools or calculations.

Integrating a Calculator into Your Investment Strategy

The Exness Investment Calculator offers many benefits that can be seamlessly integrated into your overall investment strategy:

- Backtesting and validating potential trading ideas by inputting different scenarios and analyzing the results. This allows you to evaluate the viability and risk reward profile before committing to actual funds, helping you identify pitfalls or opportunities to refine your strategy.

- Serves as an important risk management tool by providing insights into margin requirements, potential losses, and the impact of leverage. This allows you to set appropriate stop-loss levels and position sizes aligned with your risk tolerance, ultimately protecting your capital and ensuring longevity in the markets.

- Facilitates portfolio optimization by allowing you to analyze the potential costs and returns of various trading instruments, taking into account factors such as spreads, commissions, and swap rates . It helps you identify cost-effective instruments and adjust your portfolio for maximum profitability.

- Evaluating the impact of different account settings and leverage levels on potential results. By experimenting with different scenarios, you can determine the optimal leverage ratio that balances risk and potential return, aligning with your trading goals and risk appetite.

- Provides valuable insights from comprehensive calculator analysis, improving risk management skills, and ultimately contributing to smarter and potentially profitable trading decisions.

By incorporating the Exness Investment Calculator into your strategy, you can make well-informed decisions, effectively manage risk, and optimize your trading strategy for better overall performance.

Frequently Asked Questions about Investment Calculator

What is the best course of action for a $10 Exness account?

For a small $10 account, it is advisable to use lower leverage ratios such as 1:100 or 1:200 to reduce the risk of a margin call or account depletion.